Written By: Tia McCormick

There are a lot of myths out there when it comes to the home-buying process, some of which prevent people from making the investment. The Kelly Team at Envoy Mortgage is here to help debunk these myths so that you can confidently become a home owner.

Below we’re setting the record straight, but if you have additional questions, our team is always ready to answer them. Here’s what you need to know when it comes to myths that hold buyers back:

“I Need a 20% Down Payment”

According to Down Payment Resource, 70 percent of renters did not consider buying a home because of the expected large down payment. Traditionally, home buyers have put 20 percent down on a mortgage and received a 30-year-fixed loan, but this is simply no longer true. Today, there are Conventional programs available that allow buyers to put as little as 3 percent towards a down payment, and Government programs that allow for a 0% down payment opening many doors for potential home-buyers. We can help you research your options and determine what down payment and program are realistic for your financial situation.

“I Need a Higher Credit Score”

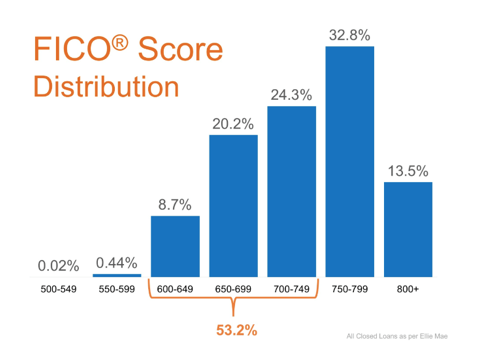

Down Payment Resource also revealed that 59 percent of Americans either are misinformed or simply don’t know what credit score is necessary to qualify for a mortgage. Most Americans believe that a “good” credit score is 780 or higher, but this Origination Insight Report from Ellie Mae proves that 53.2 percent of approved mortgages had a credit score of 600-749, as seen below.

While good credit is important for a better mortgage rate, it is possible to get approved with an “okay” credit score as well. It costs nothing for our team to find out your credit score, and qualifications, so contact our us to find out what kind of mortgage product and rate you may qualify for – you’ll probably be surprised!

“All Agents are the Same”

Within all the stresses of home buying, it’s easy to assume that most, if not all, agents or loan officers are only willing to work with certain clients in the perfect financial scenario. Believe it or not, agents do not have strict qualifications when it comes to working with new clients, and like being able to work with different financial situations and opportunities! Our loan officers have years of experience and can assist you in finding the rate, term, payment, and product that work best for you no matter your personal circumstances.

Don’t let myths like these hold you back from buying a home. The best way to be certain of your options is to speak to a professional who can answer your questions and debunk myths like these! Contact our Team today and speak with one of our Loan Officers to get started today.