By: Dan Brown

When it comes to homebuying, we’ve all heard this rule before: You should have 20 percent saved for the down payment. But is that absolutely necessary?

Putting 20 percent down certainly has its benefits, and in some cases, it can be the optimal choice. In fact, you wouldn’t have to pay private mortgage insurance (PMI) and you could borrow less from the bank. However, it’s extremely difficult to actually save up enough cash to meet a 20 percent down payment. Consider first-time homebuyers just starting their professional careers or millennials struggling to pay off college debt – it could take them years to save tens of thousands of dollars to put towards a home purchase.

If you’re hoping to buy a home but don’t have the cash for a large down payment, don’t worry – you have options. In this blog post, I offer insight into when you can consider putting down less money.

1.) To Take Advantage of Lower Rates & Home Prices

If there’s one takeaway you should get from reading this post, it’s that it is in your best interest to take advantage of low rates. Currently in the housing market, rates are much lower than expected – an opportunity that can be extremely beneficial to a homebuyer by saving them money in the long run.

Sometimes it’s better to put less than 20 percent down today in order to lock-in the lower home price and interest rate. While we cannot predict the future or fully know what’s going to happen in the market, most experts expect both rates and prices are going to rise in time. If you were to wait three years just so you could save enough cash for a 20 percent down payment, the rates will likely increase, and the same house could cost you more than it did originally, both in the price of the home and your monthly payment.

For example, let’s say the home that you’re interested in buying is currently on the market for $250,000, but you only have $40,000 saved in the bank. You need to decide whether to put down 10 percent today and buy now (before the rates and prices go up) or wait a few years to save $70,000 to put the full 20 percent down to try to avoid the PMI.

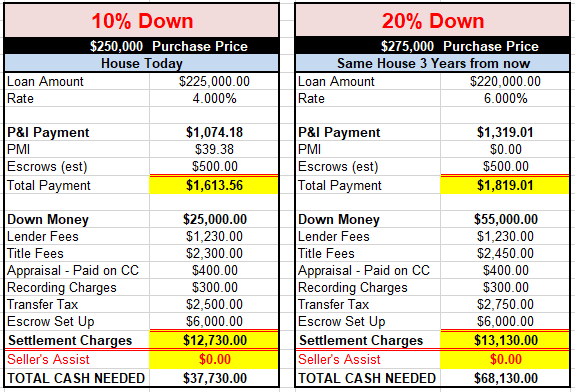

Let’s look at your buying power by doing the math, detailed in the comparison graphic below. In this example, we will assume that you have a strong credit history with annual real estate taxes of $5,000 and annual homeowners insurance of $1,000:

As you can see, if you wait, the out of pocket cost is up over $30,000 and the payment is over $200 more. But if you bought the home today and prices go up later, you already have built-in equity.

2.) To Keep Cash Liquid

Instead of putting all your savings towards a down payment, you might want to consider putting less down now to have extra savings set aside for monthly payments, home improvements, or emergency repairs. For example, you don’t want to be in a tight spot if you find out after settlement that you need to replace the roof, but do not have money to fund the repair. Rather than tying up every penny you have, keep some cash on-hand so you have a cushion against these added expenses.

It’s also important to keep in mind that roughly every $1,000 extra that is put down will only lower your P&I payment roughly $5/month. Alternatively, if you have $10,000 extra saved, you could keep it in the bank and pay a higher $50/month in P&I. Sometimes it can be easier to part with $50 monthly instead of the entire $10,000 lump cash sum, which you could invest, put towards repairs, etc.

3.) To Invest Your Money

Warren Buffet once said, “If you’re not investing, you’re doing it wrong.” Rather than taking your savings and putting it all towards a down payment, you could invest that money and let it work for you.

Homeownership is a long-term investment and equity is built over time as you pay down the balance. But “equity” in and of itself is only helpful to you when you use it – either by selling the house and getting the equity as proceeds or by borrowing against the house through refinancing or taking out a Home Equity Loan, which will likely come with added expenses. In some cases, it can be more beneficial to borrow the money up-front and to save your cash for other investment opportunities.

The key takeaway here is that you can put less down today and have extra cash in hand to invest in the stock market or to make home improvements to increase the value of your home. Plus, you could be putting equity into your home by paying off the mortgage, instead of rent.

Learn More

It is important to remember that buying a home is a long-term investment and that there are many different types of loans available to buyers looking to put less than 20 percent down. In fact, you can get in for as little as 0%, 3%, 3.5% or 5% down, depending on the loan products.

I encourage you to contact me today to learn about your loan options and to understand your buying power including factors such as PMI and interest rates — and how they will affect your monthly mortgage payment.